The retail market across the Nordics is undergoing fundamental changes from the growth of online shopping and the continued shift in consumer habits. Jussi Niemistö, part of CBRE’s Nordics Research Team, shares the findings from the Finland Retailer Sentiment Survey.

The survey was launched between the 23rd of November 2020 and 17th of January 2021. The purpose with the survey was to find out:

- The pandemic effects on the Finnish retailers

- Major concerns

- Actions taken to fight the challenging market environment.

The survey received close to 50 responses from a wide range of retailers from different industries. The largest retail sub-sectors were Food & Beverage (27%), Health & Beauty (22%), Fashion & Apparel (18%) and Grocery (11%).

Online retailing and changes in behaviors

Even before the pandemic, there were the challenges posed by the growth of online retailing and changes in customer behavior and shopping habits. Retail was divided into resilient and challenged sub-sectors during the pandemic. Groceries, hardware stores and low-cost retailers were coping well, while fashion, luxury and service-oriented sub-sectors saw the largest negative impact. Retail located in city centers saw large declines in activity as the government restrictions closed the borders from tourism and the daily traffic from work commuters quieted down due to national guidelines for remote working.

Omnichannel and Online

In the Retailer Sentiment Survey, the Finnish retailers highlighted the importance of omnichannel sales and the increasing need for more investments into online presence. 47% of the respondents were planning to increase their online sales capacity in 2021, along with a third of the retailers with plans to decrease the footprint of their sales network. The pandemic took its toll on the retailers’ leasing decisions as 36% put their expansion plans on hold and 27% gave up spaces and terminated leases during 2020.

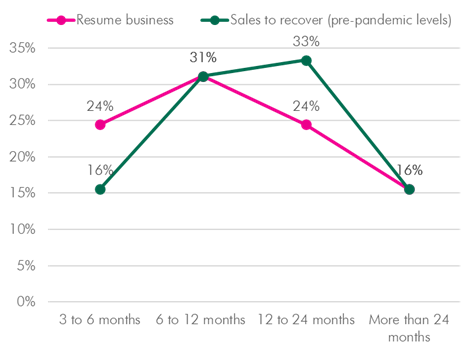

The survey results showed that the recovery for retail is estimated to be slow and getting back to pre-pandemic level revenues will take at least 12 months after the economy has been reopened. The shifts in retail strategy after COVID will be linked to investments into the efficient use of social commerce and in-store customer experiences with nearly third of the surveyed retailers planning to incorporate these strategies into their daily operations after COVID.

Figure 1. The trajectory of the retail recovery.

Source: CBRE Research, CBRE Finland Retailer Sentiment Survey - January 2021.

Summary

The pandemic has further increased the shift into online and retailers will need to invest more into omnichannel sales network and online presence. According to the CBRE Finland Retailer Sentiment Survey in January 2021, the recovery for retail is estimated to be slow and getting back to pre-pandemic level revenues will take at least 12 months after the economy has been reopened. The e-commerce growth shows no signs of slowing down and the retailers will invest heavily on social commerce and in-store experiences to succeed in the retail market after the pandemic.

Read more in the CBRE Retailer Sentiment Survey Finland January 2021 report. Click here >>

Please contact Jussi or his Research colleagues in the Nordics:

Read more about CBREs Research in Finland.