An Occupier Survey gave us the answers: CBRE Finland Occupier Flash Survey, September 2020.

CBRE Finland have surveyed over 60 occupiers in September for the CBRE Finland Occupier Flash Survey to find out their current priorities and to discover how the COVID-19 crisis has impacted their businesses and their properties. The flash survey gives a good indication of the occupier market sentiment in Finland and shines light on the future trends in the role of the office and the long-term occupier strategies.

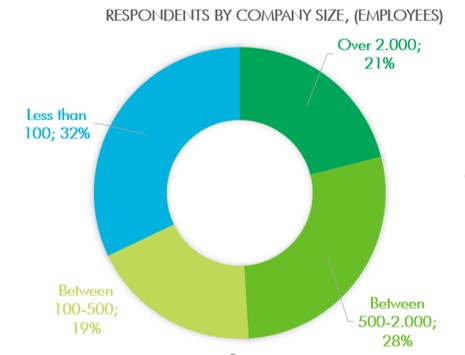

Survey profileThe CBRE Finland Occupier Flash Survey was launched between 8th and 30th of September 2020 and over 60 responses were received from a wide range of occupiers in different industries. The surveyed companies employ over 80.000 people in Finland, so the survey gives a good indication of where the Finnish occupier market is currently and what are the office space and occupier trends in the future.

Figure 1. CBRE Finland Occupier Flash Survey Profile (September 2020).

Workplace measures and expansion plans

Not surprisingly, 97% of the occupiers had increased WFH and remote working, 87% had enhanced distancing measures and 73% had provided face masks to their employees during the pandemic. Around half of the companies provided their workforce with additional WFH tools (desks, chairs, screens) and increased the flexibility of working hours as a measure to help their employees cope better with the unprecedented times of the COVID-19 outbreak.

Short term challenges

Whilst during springtime WFH was new and a break to the routines, the season has now changed. With the days becoming shorter, WFH may be considered more challenging with regards to general well-being, motivation and creativity of people. Companies will need to adjust to ensure these requirements are being met as well – especially with infection rates increasing over the past few weeks and therefore returning to the offices being delayed even further.

Furthermore, supporting and training team managers in this new way of working is crucial to ensure short and long-term success with regards to recruitment and retention of healthy, motivated people.

The COVID-19 impact on office space requirements and lease agreements

More than half of the occupiers in the survey had active projects in searches for new office space or expansion plans for the current office space before the pandemic and these plans were disrupted by delayed or cancelled site visits (15%) or delayed relocations (10%). Only a small number of occupiers put their searches and expansion plans on hold (5%) and a third of the companies had no impact on these actions due to COVID.

More than 70% of the companies indicated that there were no changes in the office space requirements or the current lease agreements from the pandemic, but the open comments related to space requirements showed that there was an element of ‘wait-and-see’ among the occupiers and the current office space was reviewed closely to fit the new normal of smaller number of desks and less density at the office. However, we see that of space searches that have been reactivated the majority has decreased the initial size requirement.

Even though a ‘wait-and-see’ mentality prevails among occupiers, there are frontrunners who have seen the pandemic as an opportunity to shape their global workplace guidelines to support the future way of working and further cost savings.

We asked our flash survey respondents what the role of the office in the future is, and the most important role for the office was for teamwork and cooperation, culture building and social interaction, whereas the focus work and concentration tasks continue to be done remotely after the pandemic. Even if it is considered that individual / focus work can be done from home to a large extent, it does not include everybody, and focus / individual areas should not completely be disregarded completely.

Offices will need to become welcoming spaces that attract people to come on site. This can be achieved by providing services, amenities, technology and spaces that together offer the user experience higher than achieved by WFH.

Long-term shifts in occupier strategy and office spaces

Occupiers highlighted the scope for longer-term shifts in strategy and space requirements with half of the responses showing either sizing down of current office spaces (52%) or assembling less dense offices (48%) in the long-term. There are also signs of combining (15%) or closing down (12%) current offices, but more importantly the Finnish occupiers suggest that the lease agreements and terms will be re-negotiated (23%) with COVID-19 clauses on a longer perspective. There have been a lot of recent discussions regarding the satellite-hub strategies and flexible workplaces and our survey results indicate that third of the Finnish occupiers plan to increase the usage of ‘On-Demand’ offices in the long run and the serviced office segment will continue to be an interesting topic among occupiers.

A significant proportion (82%) expect to have a hybrid workplace and more flexible remote working policy in the future, up from 47% before COVID-19. According to our survey results, employees will have the option for full-time remote work in the long run (27%), at least for certain groups/teams, a policy deemed unthinkable before the pandemic (0%).

Conclusion

CBRE Finland Occupier Flash Survey surveyed over 60 Finnish occupiers in September to find out their current priorities and discover how the COVID-19 crisis has impacted their businesses and their real estate. The survey results indicated that occupiers are increasingly adopting flexible ways of working and the hybrid office of the future will stand for teamwork and social cooperation. Flexibility is here to stay, and occupiers are willing to further investigate the use of ‘On Demand’ office spaces, while coping with the headcount volatility that the pandemic has increased.

Please contact Jussi or Krista for further information.

You can download the Survey here >>

Read more about CBREs Research.