We have just released our 6th edition of the Global Living report, which reviews 39 residential property markets across the globe, from Shanghai to New York. In this blog post we’ll give you the highlights. If you thought the Nordics were expensive, wait until you’ve read this!

HousingThe housing price growth pace was substantially lower in 2019 than in 2018, with Munich coming in highest at 11%. The main reason for the slower growth pace is a wide range of cooling measures introduced by governments to improve affordability for residents.

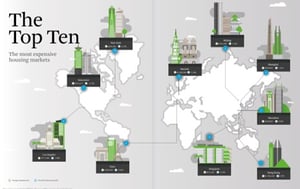

The most expensive housing markets were Hong Kong, Munich and Singapore. The average property price in Hong Kong was no less than USD 1,254,000. The “cheapest” market on the top 10 list was New York with an average property price of USD 649,000.

The top 3 most expensive cities to rent in remained New York, Abu Dhabi and Hong Kong. In New York, the average monthly rent is USD 2,870.

Market dynamics in Bangkok, Berlin, Dublin and Vancouver

Bangkok saw a large uptick in transactions with 25%. The market is viewed as attractive for international investors, for instance from China, due to affordability and its prospect of capital appreciation. House price growth was at 6%, although stricter borrowing conditions and rising land prices can potentially temper rates of growth.

House prices in Berlin grew by 10% in 2019, only slightly behind Munich and Cairo. It is still however affordable by global standards. Due to the introduction of rent regulations, rents only increased by 1% in 2019 (versus 5% in 2018). Despite concerns of a housing market bubble, Berlin rents remain low in a global context (USD 760 per calendar month versus USD 1,400 across the 39 markets in the report). The 5-year rent freeze introduced in 2020 will benefit 1.5 million renters but will put off investors.

Dublin has transformed into an employment hub and magnet for tech corporations, which has pushed up rental costs. New housing supply however should help moderate prices.

Vancouver ranks #7 on the most expensive – list. Various cooling measures have been introduced since 2016, including higher taxes for foreign buyers and on high value properties, resulting in a price decline of 3% in 2019. 37% of all households rent, and the average monthly rent was USD 1,110 pcm. Changes in planning policy has helped encourage residential construction.

Some Nordic reference points

The Nordics are not included in the Global living report, so we have summarized the markets below as a comparison.

In Sweden, house prices grew by 3.7% in Stockholm county in 2019 and the average property price was SEK 5.6 million (about USD 585,700). In Stockholm municipality, the rents grew by 2.7%. Renting a 70-square-meter apartment would on average cost you SEK 7,910 pcm (USD 820).

In Oslo, house prices grew by 5% during 2019 and the average price per residential property was NOK 5.3 million (about USD 609,200). In Oslo and Baerum municipality, an average monthly rent would be NOK 11,650 pcm (USD 1,339).

In the Helsinki Metropolitan Area, house prices grew by 2.4% in 2019 and the average price per square meter was EUR 3,719(excluding new development). The rent in Helsinki was roughly EUR 1,184 pcm (USD 1,326) for a 70-square-meter apartment in 2019.

In Region Hovedstaden in Denmark, the average price per property was DDK 3.9 million for a house (USD 589,000). The house price growth was 2.8% y-o-y. An average monthly rent would be roughly DKK 10,800 (USD 1,621) for a 70-square-meter apartment.

For the full report, feel free to download it below.

Exchange rates: USD/NOK = 8.70, USD/SEK = 9.65, USD/DKK = 6.66, EUR/USD = 1.12.

Sources:

Statistics Denmark, Statistics Norway (SSB), Statistics Sweden (SCB), Svensk Mäklarstatistik, Statistics Finland (Tilastokeskus).