The disruption of the commercial property market, caused by the COVID-19 outbreak, was unprecedented in modern history. The underlying structural trends that already were underway have shifted gear to full power. Dragana Marina, part of CBRE’s Nordics Research Team reveals more in this article.

While there were no property market segments that were immune to pandemics, some have proven to be more resilient than others. The current environment continues to progressively highlight the favourable position alternative sectors are in. As occupier fundamentals across various market segments have been affected, alternative sectors have shown a better level of protection against the volatility in employment and output figures. Due to their non-cyclical nature, they will continue to be increasingly appealing to investors.

The senior housing market segment is evolving

When talking about senior housing as an investment product, we often refer to it as an ‘alternative sector’ or ‘operational sector’. And the very perception of operational real estate sectors (where we also have healthcare and student housing, education and leisure, self-storage and data centres) as just a niche area for opportunistic investment has changed greatly in recent years. This reflects the emergence of investors with advanced sector knowledge, more sophisticated lease underwriting and proliferation of specialist advisers. Seniors housing is different from most other real estate types because the value is largely contingent on operations. Still, lenders and investors are typically most interested in real estate when deciding whether or not to provide capital.

The maturity of the sector varies across the Nordics; Finland and Sweden taking the lead. In these countries, the share of the senior home services operated by private companies is 50% and 20% respectively. In Denmark, on the other hand, the share of private service operators is still small but rising. In 2015, the Danish parliament amended the so-called ‘friplejelov’ making it possible for investors to build senior housing and then rent it out to an operator. Before the change in the law, the operator also had to be the owner of the property.

From where we are standing, we see that investor appetite for senior housing (and operational real estate in general) is increasing across the region and will continue to do so. This is primarily driven by two megatrends: the change in investment approach from providing space as a product to embracing space as a service; and the long-term structural trends stemming from accelerating economic and social megatrends. Moreover, senior housing can be a good portfolio diversifier, enabling investors to balance risk exposure within a sector and more widely as well as with the use of investment structures. This enables investors and managers to create bespoke opportunities from a wide menu of risk and return attributes, selecting and blending risk dimensions.

Demographic demand

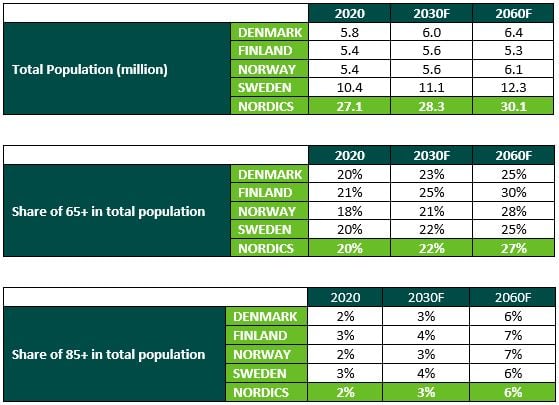

Senior Housing demand is clearly driven by demographic development. The baby boomers (babies born in the years following World War II) began turning 65 in 2011. By 2030, the remainder will also reach age 65 and account for approximately 22% of the total aggregated population in the Nordics. More importantly, by 2030, the 65-plus age group is estimated to be larger than the population under the age 18. The projected growth in the senior population will present many challenges to policymakers and programmes by having a significant impact on families, businesses, healthcare providers and, most notably, on the demand for senior housing.

Table 1. Population projections, Nordics

Source: National Statistical Offices, CBRE Research

With all this in mind, over the next decade, the senior housing industry across the Nordics is well-positioned for investment opportunity and, more broadly, for increased significance within the commercial real estate industry. Rising demand, growing inventory and evolving product mix will create attractive opportunities and investment returns for owners, buyers and operators of senior housing.

To stay or to move?

An important question here is: with the increase in the 65+ age group, will a higher percentage of elderly people choose to move out of their homes and into senior housing communities? A few cultural and technological trends on the horizon point to outcomes that would either increase or decrease these levels.

Many trends could allow seniors to stay at home longer. Among the most notable are telemedicine and improved home health care services. Ridesharing programmes allow greater mobility for seniors not able to drive or without access to public transportation. Online shopping, including groceries, is another. The shared economy will provide many more solutions for elderly people living at home.

But the increased appeal of senior housing options over the medium term is also based on the premise that new senior housing product offerings and models will not be simply updates of the senior housing communities where the baby boomers’ parents lived. Assuming the industry provides modern communities with rich amenities, they will likely be very appealing to a generation to which lifestyle is very important.

Another trend that may also lead to a higher acceptance of senior housing by baby boomers is a desire to have a ‘lock-and-leave’ housing situation. Baby boomers have travelled far more than previous generations and are likely to continue to do so well into their senior years.

The multitude of possibilities

For the most part, the traditional segments of seniors housing – independent living, assisted living, memory care and nursing care – are not yet benefiting from baby boomer demand. However, the emerging ‘active adult’ segment, focused on a younger demographic that includes baby boomers, is well-positioned to attract new demand.

Independent living is focused on lifestyle enhancement and is therefore appealing to baby boomers. ‘Active adult’ housing, also referred to as ‘55+’ or ‘age-restricted’, has not traditionally been part of the senior housing sector. However, in years ahead, the active adult segment will play a larger role in the senior housing industry and will be an exciting segment to follow as it evolves. The definition of senior housing and what it comprises continues to evolve, especially as product segmentation lines become less distinctive.

Another segment of senior housing on the rise is the ‘continuing care retirement communities (CCRCs)’, which we see a lot of in the US, also known as life plan communities. This is particularly attractive to so-called ‘planners’ – individuals and couples with a long-term outlook on their housing needs and a desire to plan for their future. The principal philosophy is that seniors can age within one community rather than change communities when lifestyle preferences and health care needs evolve. Additionally, couples with health care needs that evolve differently from each other can continue to live in one community.

Appeal to investor

Sector fundamentals are clearly very favourable and herein lies the opportunity for both developers, investors and providers involved in senior housing. There are basically five primary factors that attract investors to senior housing and the alternative sector in general.

- Yield premium

Even with yield compression in recent years, most alternative assets trade at higher yields than conventional real estate. In Denmark, compared to traditional asset classes such as office, retail and multifamily, senior housing trades at a premium. As of Q3 2020, the prime yield for senior housing was at 4.5%, remaining stable from 2019. In Finland, the prime yield for senior housing contracted from 6.25% in 2015 to 4.85% in 2020. In Sweden, from 5.25% in 2015 to 3.85% in 2020. - Rising market demand

The sustained economic expansion over the past ten years has been a major driver of market demand for alternative assets. Even more powerful, however, have been the structural changes in business, technology, demographics and society, leading to a significant growth in the market demand for most alternatives.

The demand for senior housing has not risen dramatically this decade, but this will change over the next ten years as baby boomers reach ages traditionally appealing for senior housing. - Expanded product availability

The alternative sectors have provided investors with another avenue for investment, particularly important in the competitive Nordic investment landscape over the past several years. - Portfolio diversification

Multi-property investors, particularly institutional investors, demand property diversification in their portfolios. Diversification can often be accomplished through traditional property types. Still, greater investment in alternatives has provided another opportunity, especially with many investors typically overweighed in office and retail and unable to acquire enough logistics assets to meet their goals. - Transparency

Greater transparency in pricing, market performance and operations provide prospective investors with a deeper understanding of alternative sectors and greater comfort in investing in them. Improved transparency should also mitigate risk. While coverage of the alternative sectors is not as rich as for the traditional sectors, there is a rising number of information on performance measurements. Greater transparency will continue and help make alternative sectors more attractive to investors not thoroughly familiar with the product.

Conclusion

Demographic development will be the driving force behind the evolution of the senior housing market segment across the Nordics. By 2060, the 65-plus age group in the Nordics is estimated to exceed 8 million, a more than 45% increase over its estimated 2020 population (5.4 million). The same projection for the 85-plus group is even higher. By 2060, the 85-plus age group is estimated to exceed 1.9 million, a 190% increase over its estimated 2020 population (670,000). Certainly, figures to think about.

Senior housing as an investment product will, therefore, be on the radar for many market stakeholders. Additionally, new sources of capital, including institutional and cross-border, are expected to bring more liquidity into the sector. The benefits for prospective investors will include a yield premium on pricing over other investment products, less variability in occupancy and less risk of oversupply.

Please contact Dragana Marina if you have questions or would like to book a meeting wih her.