CBRE Nordics organized a successful event in Copenhagen on 2 February. The speaker lineup consisted of CBRE’s in-house experts as well as guest speakers from different sectors and industries. The event was moderated by TV host and journalist Nynne Bjerre Christensen.

Global and European Outlook 2023

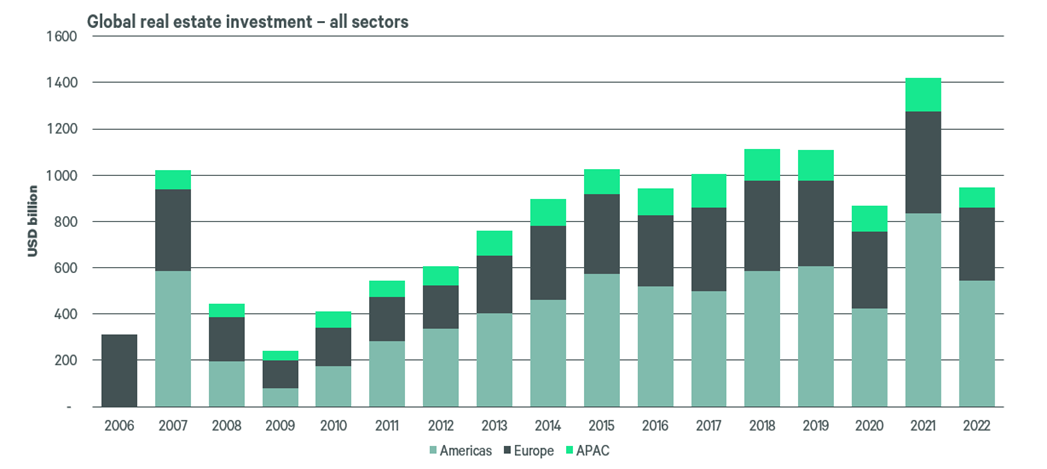

Richard Barkham, CBRE’s Global Head of Research and Chief Economist, opened the event with a round-up of the global economy and real estate markets. The global economy has remained strong in 2022, but higher inflation and increased interest rates on the back of central bank monetary tightening will slow down the global economy in 2023.

After Richard Barkham’s presentation, the focus was turned to the European and Nordic markets. Jos Tromp, CBRE’s Head of Research, Continental Europe, highlighted that the three first quarters of 2022 were very strong, but activity slowed significantly in the last quarter of 2022.

Global Real Estate Investment

Source: CBRE Research

Sustainability will keep its position as an important theme for both investors and occupiers in the real estate market in 2023, and Jos reminded us that there is a clear business case for sustainable real estate through the findings of CBRE Research.

The business case for sustainable real estate includes:

- Lower voids

- Faster leasing

- Increased covenant strength

- More liquidity

- Better leasing terms

The key takeaways for European real estate markets in 2023 :

- There is a window of opportunity opening in the real estate investment market in 2023 as the pricing environment balances out

- Occupier markets will remain solid in 2023 despite the economic slowdown

- Environmental and sustainability will stay in the leaders’ boardroom conversation as important topics

Nordic Market Outlook 2023

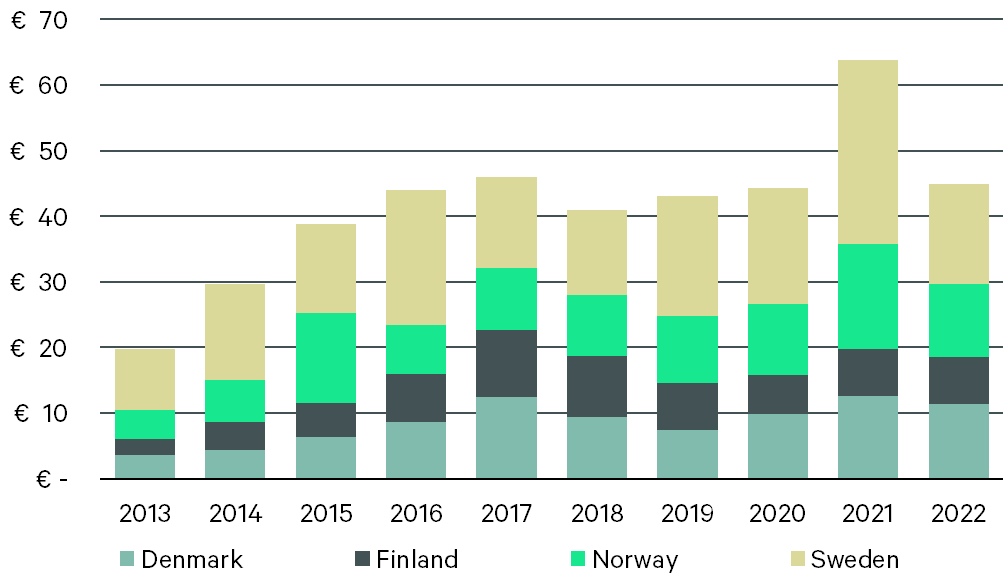

Next on the agenda were the key themes of investment activity and financing costs in the Nordics, presented by Jørgen Arnesen, Head of Real Estate Investment Banking, Nordics, and Mads Romild, Director of Debt & Structured Finance, Denmark.

Jorgen highlighted that the Nordics saw a strong year in 2022 despite the uncertainty and headwinds from inflation and higher rates, and investment volumes reached more than €45 billion, down by a third from the record volumes of 2021. Finland was the only country recording growth in volume (€7.2 billion, up 1% year-over-year), while Sweden (€15.3 billion, -52%), Denmark (€11.4 bn, -10%) and Norway (€11.1 bn, -31%) saw declines in investment from the previous year.

Mads talked about the shifts in the financing environment in the Nordics and reminded us that real estate sector Loan-to-Value levels are lower and Nordic banks are better capitalized than during the Global Financial Crisis. Cost of capital continues to be a key theme for the Nordic real estate market, and CBRE is closely following the development of the bond market in 2023, and especially the refinancing activity of the Nordic listed sector.

Nordic Investment Volumes

Source: CBRE Research

Jorgen summarized the key themes for investors in 2023 to be the following:

- Nordic investment volumes to remain sound – activity expected to pick up in the second half

- Investors taking a wait-and-see approach and expecting further price discounts

- Sector rotation and pricing impact to continue due to the cost of debt and market volatility

- Continued change in net buyers/sellers – international interest expected to increase, Nordics as “safe haven”

- CPI indexation, strong fundamentals and rental growth offsetting an element of negative carry

- Some distress opportunities are expected, however lower LTVs and supportive, well-capitalised Nordic banks to soften the landing

The second half of the event was focused on sustainability and financing the net zero transition in the Nordics. The headline was Can sustainability offer additional protection in uncertain times? Dragana Marina, Head of Research & Data Intelligence, CBRE Denmark, and Sustainability Research Lead, Continental Europe.

Panel discussion: Financing the net-zero transition

Stefani Papadaki, Head of ESG, CBRE Denmark

Elisabeth Hermann Frederiksen, Head of Sustainability, NREP

Hans Gregersen, Chief Analyst, Business Banking – Corporate Advisory, Nordea

Did you miss the event? Please reach out to your CBRE advisor to receive the material for the event. You can view the event by clicking on the bottom below.