The Sustainable Finance Disclosure Regulation (SFDR) is part of the European action plan for Sustainable finance. It increases transparency with ESG related investments, setting disclosure requirements for Financial Market Participants (FMPs) in the European Union. After June 2021, large companies with more than 500 employees must comply with the Principal Adverse Impact (PAI) requirement and publish a PAI disclosure.

Main considerations

Many authors argue that the EU rules have sparked a green rush, with investment firms being fast to badge their products as sustainable to secure a share of the booming market of sustainable funds. The danger lies in funds over-emphasising the benefits of a business or assets to attract environmentally aware investors, as there are clear commercial opportunities deriving from strong demand for funds with a sustainable label.

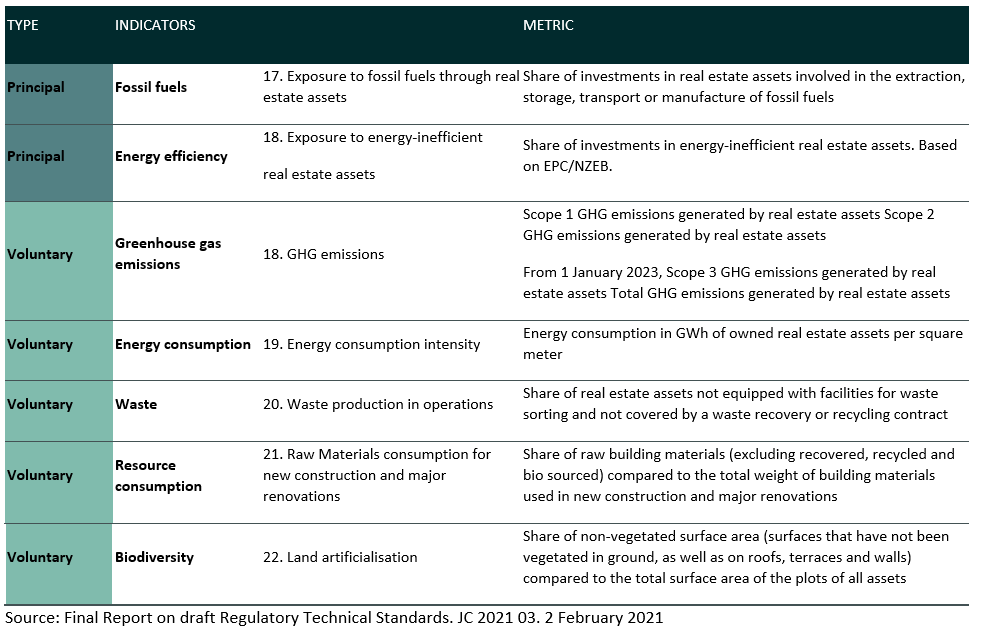

The self-assessment process is not against the law. Asset managers do determine themselves which article to apply and EU is not following up whether this is justified. However, from January 2023, funds will be obliged to detail how they meet sustainability criteria based on the EU’s Regulatory Technical Standards (RTS). In this part of directive, asset managers will have to report on 18 principle adverse impact statements (PAIS). The data scarcity can though pose significant challenges. Two of the 18 PAIS are specific to real estate:

1. the exposure to fossil fuels through real estate assets, measured as the share of investments in real estate assets involved in the extraction, storage, transport, or manufacture of fossil fuels; and

2. the exposure to energy-inefficient real estate assets.

SFDR ADVERSE IMPACT METRICS: REAL ESTATE ASSETS

Classification

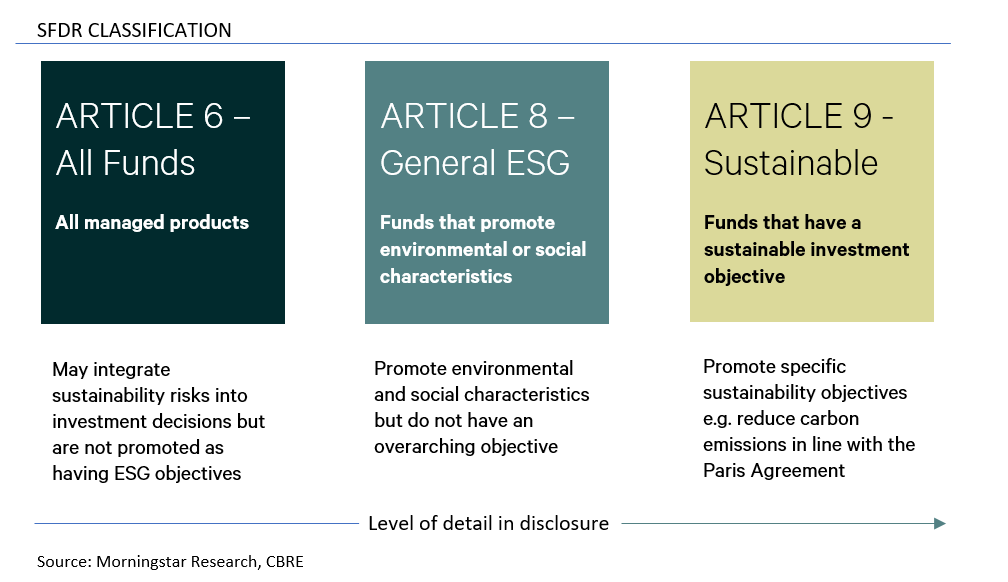

The SFDR rules affect all products managed by EU entities. There are three distinct categories: Article 6, Article 8 and Article 9.

Morningstar data published in November 2021 shows Article 8 and 9 funds account for 33.0% and 3.9%, respectively, of reviewed fund assets and amount to EUR 3.3 trillion in total. By mid-2022, Article 8 and 9 products could reach half of total assets in scope of SFDR. One of the main challenges is the wealth of approaches taken by the asset managers, all depending on their interpretation of the regulation. Morningstar analysis suggests that while some asset managers have taken a too prudent approach, others have probably been too generous. Further on, the analysis concludes that clarification remains pending on implementation details of both the disclosure (SFDR) and taxonomy regulations.

Conclusion

A reliance on voluntary labels is standing opposite to the need to scale up the entire investment industry. The SFDR debate has demonstrated the need for market standardisation and regulation, paving the way to end greenwashing. Still, many challenges remain open, such as the quality, availability, and comparability of ESG data; application to pension funds; the use of ESG thresholds to justify sustainability labels etc.

This in mind in mind, actions for property owners and managers include ensuring a robust data management system is in place, allowing for an overview of both corporate and investment data gaps and sources to be targeted. Furthermore, overview of products defined as Article 8 and 9 by the SFDR; ensuring alignment with RTS and finally structuring reporting standards and cycles to align with the EU Taxonomy.